提高效率,降低风险

交易后解决方案助力客户在整个交易后服务环节提升效率,优化资本运用。通过连接现有清算基础设施,我们将清算的优势引入双边交易领域,让客户无论选择在何处进行风险交易,都能推动效率提升。

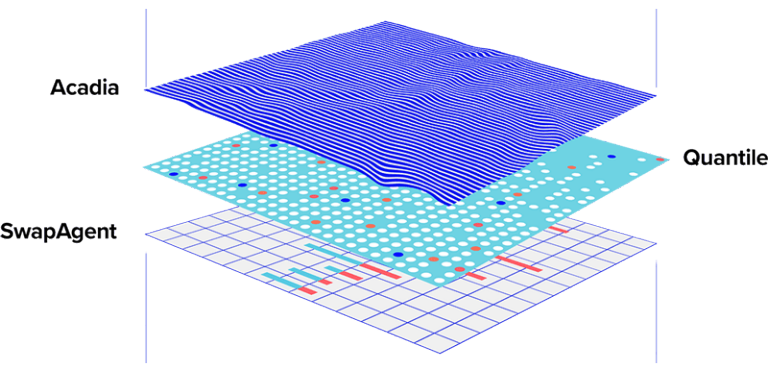

我们与市场参与者协作,共同识别痛点,从而提供能显著改进流程并降低成本的解决方案。通过整合三家创新型企业的力量,我们的目标是重塑交易后服务的格局。

携手共创交易后新格局

实用链接

为助您攻克痛点,我们整合了三家创新型企业:

特色与优势

为何选择交易后解决方案

工作流

将清算优势引入双边交易领域

我们正在持续推进交易后服务的转型

从每一个市场参与者都需要:

- 独立存储交易数据

- 维护大量的双边对账流程

- 支持多种交易后工作流

向一套无缝化流程转型:

- 所有工作流通过集中式服务交付,并由权威交易数据支持

- 流程完全自动化

- 在优化资本和成本的同时降低风险

客户评价

交易后解决方案堪称典范,彰显了 LSEG 如何助力像我们这样的客户管理风险,满足日益严苛的监管要求,并持续优化资本效率。 在与高盛集团及市场参与者协商后,LSEG 正寻求将清算市场的最佳实践与创新成果引入非清算市场。 因此,我预期整个行业将随时可以使用更完善的工具,既能更好地管理风险,也能优化资本使用效率。

高盛

查看详情

想进一步了解我们的产品?联系我们专业的销售团队,为您解答疑问。

我们的压缩和优化服务通过 Quantile 提供。点击了解更多 Quantile 监管相关信息(英文)。